Start your business in Delaware

Start your company in Delaware

Pros & Cons

Favorable business laws > Delaware's pro-business corporate law offers flexibility in company structuring. The renowned Delaware Court of Chancery efficiently handles corporate disputes, leading to faster, more predictable outcomes

Privacy protection > Delaware corporations enjoy enhanced privacy, with no requirement to disclose directors' and officers' names publicly, providing anonymity for company management

Tax benefits > Delaware provides tax benefits for companies, including no state corporate income tax for out-of-state operations, no personal income tax for non-residents, and no value-added taxes. These benefits contribute to the appeal of registering a business in Delaware

Efficient incorporation process > To form a Delaware corporation or starting an LLC in Delaware is simple, fast, and cost-effective, with the efficient Delaware Division of Corporations often completing formations within 24 hours

Prestige and credibility > By choosing to register a business in Delaware, you can take advantage of the state's pro-business environment and association with Fortune 500 companies. This connection with corporate prestige enhances credibility for investors, customers, and partners, making it an attractive option for company formation

Annual taxes > Choosing to register business in Delaware Delaware corporations and LLCs are required to pay annual taxes which can be a disadvantage to startups

Whom we have helped

Start your Delaware LLC or Corporation today

Start your companyIs a Delaware LLC or Corporation the right entity type for you?

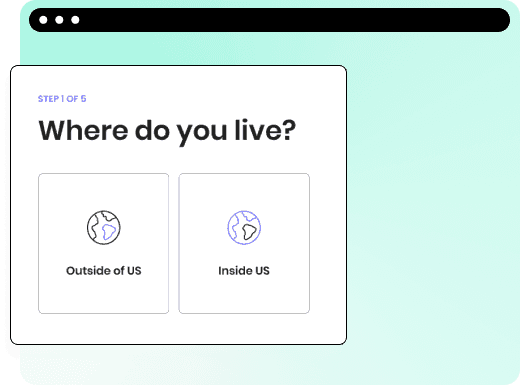

You can use our tool to guide you in choosing the best state for your company.