Delaware vs California

Who should form a Corporation in which State

Delaware

When choosing between incorporating in California vs. Delaware, you should consider Delaware's flexible pro-business laws, renowned court system, and privacy protection make it ideal for incorporation. Tax benefits and added prestige attract investors and enhance credibility.

California

When deciding between a Delaware vs California corporation, you should keep in mind California's vast resources, innovative environment, and state-specific incentives foster growth. Its diverse talent pool and industry hubs provide valuable networking opportunities.

Delaware Pros & Cons

Favorable business laws > Delaware's pro-business corporate law offers flexibility in company structuring. The renowned Delaware Court of Chancery efficiently handles corporate disputes, leading to faster, more predictable outcomes giving an advantage to Delaware in the Delaware vs California corporation debate

Privacy protection > When considering California vs Delaware LLC, you should know that Delaware companies enjoy enhanced privacy, with no requirement to disclose directors' and officers' names publicly, providing anonymity for company management

Tax benefits > Delaware provides tax benefits for companies, including no state corporate income tax for out-of-state operations, no personal income tax for non-residents, and no value-added taxes

Efficient incorporation process > Forming a company in Delaware is simple, fast, and cost-effective, with the efficient Delaware Division of Corporations often completing formations within 24 hours giving a big advantage to Delaware in the Delaware vs California corporation debate

Prestige and credibility > Delaware's pro-business environment and association with Fortune 500 companies make it synonymous with corporate prestige, enhancing credibility for investors, customers, and partners

Annual taxes > Delaware corporations and LLCs are required to pay annual taxes which can be a disadvantage to startups

Delaware use cases

California Pros & Cons

Local presence > If your business primarily operates in the state, forming your California vs Delaware LLC can make it easier to establish a local presence and comply with state-specific regulations

Access to resources > California offers a wealth of resources, including a large and diverse talent pool, numerous industry hubs, and a strong network of investors and partners

Innovation > California is known for its innovative business environment, with many startups and established companies thriving in sectors like technology, entertainment, and green energy

State-specific incentives > California provides various incentives and financial programs to support businesses, such as tax credits, grants, and loans for specific industries or regions

Familiarity with state laws > Incorporating in California means that your company's legal matters will be governed by California laws, which may be more familiar to local businesses and legal professionals

Taxes and regulation > California is known for its higher tax rates and complex regulatory environment, which can be burdensome for businesses. When considering California vs Delaware LLC, you should know you may face higher costs and stringent compliance requirements

California use cases

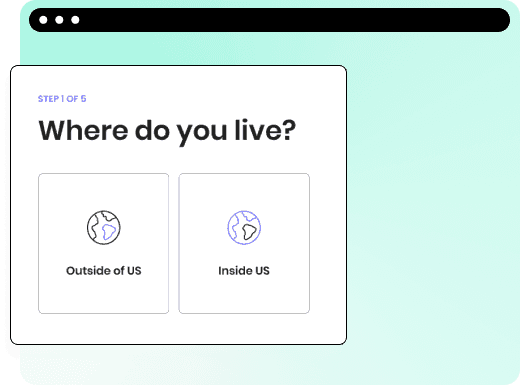

Debating whether Delaware or California is right for you?

You can use our tool to guide you in choosing the best state for your company.