Delaware vs Wyoming

Who should form a Corporation in which State

Delaware

Delaware's flexible pro-business laws, renowned court system, and privacy protection make it ideal for incorporation. Tax benefits and added prestige attract investors and enhance credibility. When deciding between Delaware vs Wyoming corporation, Delaware offers many advantages.

Wyoming

Wyoming offers attractive tax benefits, privacy protection, strong asset protection, and simple registration. Its perpetual company existence policy supports long-term planning and growth. Wyoming offers many advantages in the Wyoming vs Delaware LLC debate.

Delaware Pros & Cons

Favorable business laws > When considering incorporating in Wyoming vs Delaware, it's important to note that Delaware's pro-business corporate law offers flexibility in company structuring. The renowned Delaware Court of Chancery efficiently handles corporate disputes, leading to faster, more predictable outcomes, which can be a deciding factor for some business owners.

Privacy protection > Delaware corporations offer several advantages, such as enhanced privacy, which can be an important factor in the Delaware vs Wyoming corporation debate. In Delaware, there is no requirement to disclose directors' and officers' names publicly, providing anonymity for company management.

Tax benefits > Delaware provides tax benefits for companies, including no state corporate income tax for out-of-state operations, no personal income tax for non-residents, and no value-added taxes. When deciding between a Delaware vs Wyoming corporation, you should consider the tax benefits

Efficient incorporation process > Forming a company in Delaware is simple, fast, and cost-effective, with the efficient Delaware Division of Corporations often completing formations within 24 hours which is an important consideration in the incorporating in Wyoming vs Delaware decision

Prestige and credibility > When deciding between incorporating in Wyoming vs Delaware, one should consider that Delaware's pro-business environment and association with Fortune 500 companies make it synonymous with corporate prestige, enhancing credibility for investors, customers, and partners. This aspect can play a significant role in the decision-making process for business owners.

Annual taxes > Delaware corporations and LLCs are required to pay annual taxes which can be a disadvantage to startups. These annual fees are important to consider when deciding between incorporating in Wyoming vs Delaware

Delaware use cases

Wyoming Pros & Cons

Tax benefits > Wyoming has no corporate or personal income tax, no franchise tax, and low sales and property taxes, making it attractive for businesses. The tax consideration is important in the Wyoming vs Delaware LLC decision.

Privacy protection > In the comparison of Wyoming vs Delaware LLC, Wyoming allows anonymity for company owners and directors, providing greater privacy for management and potentially influencing the choice between the two states.

Asset protection > The state offers strong asset protection, including favorable laws for creating and maintaining Limited Liability Companies (LLCs), making the Wyoming vs Delaware LLC decision an important consideration. Additionally, there is charging order protection available for added security.

Efficient registration process > Forming a company in Wyoming is straightforward, with low filing fees and a streamlined process for business registration

Continuity > Wyoming allows for the perpetual existence of a company, which can be beneficial for long-term planning and growth another factor to consider when deciding between a Delaware vs Wyoming corporation

Limited recognition > Wyoming's reputation as a business-friendly state is growing, but it may not yet have the same level of prestige or recognition as Delaware. This could impact the perception of your company by investors, clients, or partners

Wyoming use cases

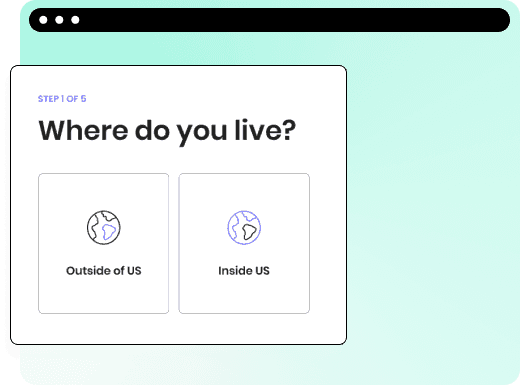

Debating whether Delaware or Wyoming is right for you?

You can use our tool to guide you in choosing the best state for your company.