Start your business in Wyoming

Start your company in Wyoming

Pros & Cons

Tax benefits > Wyoming has no corporate or personal income tax, no franchise tax, and low sales and property taxes, making it attractive for businesses

Privacy protection > Wyoming business registration allows anonymity for company owners and directors, providing greater privacy for management

Asset protection > Wyoming business registration offers strong asset protection, including favorable laws for creating and maintaining Limited Liability Companies (LLCs) and charging order protection

Efficient registration process > Wyoming business registration is straightforward, with low filing fees and a streamlined process for business registration

Continuity > Wyoming business registration allows for the perpetual existence of a company, which can be beneficial for long-term planning and growth

Limited recognition > Wyoming's reputation as a business-friendly state is growing, but it may not yet have the same level of prestige or recognition as Delaware. This could impact the perception of your company by investors, clients, or partners

Who we helped

Start Your LLC, S-Corp or C-Corp today

Start your companyIs a Wyoming LLC or Corporation the right entity type for you?

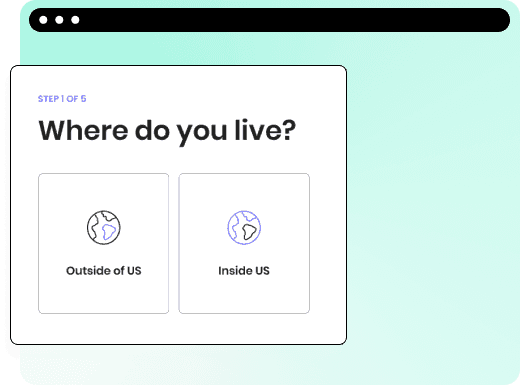

You can use our tool to guide you in choosing the best state for your company.